- Factory's Post 🇪🇺

- Posts

- Factory's Post 🇪🇺 #12

Factory's Post 🇪🇺 #12

[123 Factory] Monthly Newsletter January 2026

Factory's Post is back to deliver the insights you need for your business growth.💡 We've gathered the latest business trends, useful information for market entry, and hot news from the Korea-Europe ecosystem!

Happy to greet you with our first newsletter of 2026!

As we welcome the new year, it is a crucial time to reflect on where the Korean tech ecosystem stands and where it is headed. Based on a review of 2025 and the record-breaking forecasts for 2026, let's explore how to navigate the upcoming shifts in the AI and semiconductor landscapes. 🧐

⚖️ Building the Foundation: AI Policy and Infrastructure

image=bloomberg

In 2025, Korea successfully laid the groundwork for becoming one of the top three global AI powerhouses by establishing the "AI Basic Act" and securing massive infrastructure investments. The year was marked by a shift from theoretical AI to practical industrial integration, with significant progress in GPU procurement and domestic AI chip development. These efforts have paved the way for a more robust and regulated ecosystem, ready for large-scale commercialisation in 2026.

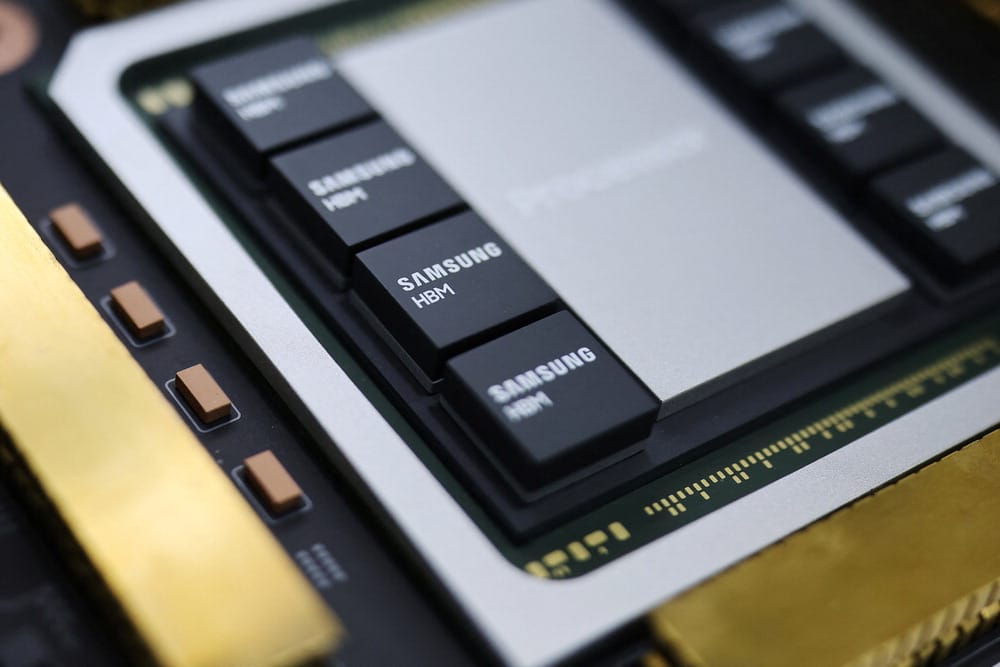

📈 A New Era: The Semiconductor Super Cycle

Samsung Electronics' HBM4, image=Reuters Yonhap News

The semiconductor sector is set to reach unprecedented heights in 2026, with the memory market expected to surpass previous historical peaks. Driven by the relentless demand for AI infrastructure, industry giants like Samsung Electronics and SK Hynix are projected to achieve record-breaking operating profits. The HBM (High Bandwidth Memory) market alone is forecasted to approach $60 billion, solidifying Korea's dominance in the global AI supply chain.

🤝 Strategic Synergy: Opportunities for Global Partners

For European startups and investors, this synergy between foundational AI policy and hardware leadership creates a unique entry point into the Asian market. The integration of advanced memory technology with "Agentic AI" is expected to spark new B2B opportunities across manufacturing and services. As Korea transitions from infrastructure building to full-scale AI application, the demand for innovative software partners from Europe is higher than ever.

🏆 “2026 Emerging AI+X Top 100” Revealed

image=AIIA

The Artificial Intelligence Industry Association (AIIA) has also released the "2026 Emerging AI+X Top 100," identifying key players integrating AI across industries to drive innovation. From over 3,000 candidates, these companies underwent rigorous verification by industry experts and VCs based on quantitative and qualitative metrics. The list highlights the most promising firms demonstrating stability, growth potential, and future value in the Korean market. For European innovators, this list offers a verified map of potential partners when expanding into the Asian AI market.

In a nutshell, 2026 will be the year when Korea’s long-term investments in AI policy and next-generation semiconductors finally converge to create unparalleled market growth. This "Super Cycle" offers a strategic window for global collaborators to leverage Korea's world-class hardware and expanding AI ecosystem. Stay ahead of the curve by monitoring these two pillars of innovation. Read more detailed articles here: [link 1] [link 2].

Event

🏆 K-Startups’ CES 2026 Moment: Awards, Scale, and Global Signals

image=CES 2026

Korea entered CES 2026 (Jan 6-9, Las Vegas) with exceptional momentum. CES Innovation Awards results show 168 Korean companies winning awards, including Best of Innovation, around 60% of all award-winning companies. SMEs and startups accounted for 137 of them. This concentration signals more than visibility; it reflects a maturing pipeline of globally market-ready technologies across AI, mobility, energy, digital health, and fintech.

With more than 900 companies/institutions participating, Korea's CES performance increasingly reflects a system outcome - awards + coordinated market-entry infrastructure - and that matters for European startups and corporates scanning Asia. If you're building in regulated, cost-sensitive markets, Korea is becoming an efficient place to source high-performing components, applied AI, and commercialisation-ready partners.

Investment

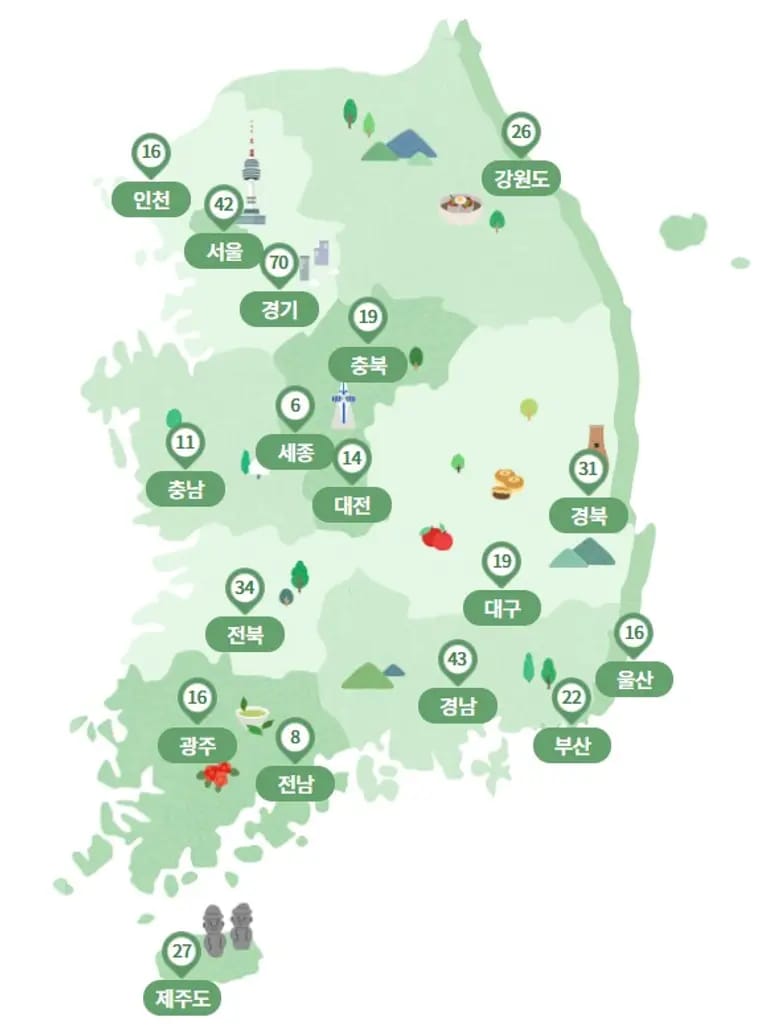

📊 Startup Support Scales Up to a Record KRW 3.4645T for 2026

image=Korea Startup Post

Korean government has confirmed a record KRW 3.4645 trillion (up 5.2% YoY) in startup support for 2026, spanning 508 programs across 111 public institutions (15 central ministries + 96 local governments). The budget is heavily weighted toward loans & guarantees (41.1%), alongside R&D (25.0%) and commercialisation (23.5%)—together accounting for ~90% of total support.

Notably, R&D funding rises by KRW 235.6B, including support of up to KRW 1.5B per year for up to 3 years for startups under 7 years old, while youth startup programs also expand (to KRW 257.5B). For European founders and innovation teams eyeing Korea, this signals a larger pool of co-development opportunities, especially in strategic tech areas, but also a market where “support” may mean more debt financing, so partner selection and funding structure matter.

The government also introduced more “field-friendly” execution rules—e.g., allowing instalment payments for outsourced services, supporting IP maintenance costs, and adding insurance support for tech infringement lawsuits, while tightening penalties for fraud. In a nutshell: more money, more R&D, and clearer guardrails—but startups still worry about interest-rate burdens, making private capital (and cross-border partnerships) even more critical.

Open Call

🧪 Korea–Germany Joint Research Program 2026: Engineering & ICT Collaboration

|  |

The National Research Foundation of Korea (NRF) and the German Research Foundation (DFG) have officially launched the Korea–Germany Joint Research Program 2026, inviting joint proposals in engineering sciences, including ICT and convergence technologies. The program will support around 20 bilateral projects for up to three years, aiming to strengthen long-term research partnerships between leading Korean and German research groups.

👉 Key Infos

Fields: Engineering sciences, ICT & convergence (excluding life sciences, humanities, and social sciences)

Project duration: 3 years

Funding:

Korea: up to KRW 150 million per year per project (via NRF)

Germany: according to DFG Individual Research Grants

Deadline: 11 March 2026

Project start: 1 December 2026

Overall, this open call represents a strong opportunity for researchers seeking high-impact Korea–Germany collaboration in advanced engineering and digital technologies, backed by substantial public funding on both sides. Full call details and official guidelines are available here: [NRF] [DFG].

Meet New Startups!

We'd like to take a moment to introduce you to some of the startups that will be joining us in the coming days. Today, we introduce you to DAY1LAB, a sspecialisedalternative plastic materials company dedicated to people and nature.

🌿 Sustainable Polymer Innovation

image=DAY1LAB

DAY1LAB is revolutionising the plastic industry with RETARCH, a natural polymer plastic alternative. Engineered from 100% biobased starch-cellulose composites, RETARCH dramatically reduces carbon emissions and offers a complete solution to the microplastic crisis. Unlike traditional plastics, it degrades fully without generating microplastics or heavy metals, making it safe for both humans and the environment. This material boasts a multi-environment degradation capability, decomposing safely in diverse conditions, including industrial and home composting.

Beyond safety, DAY1LAB’s technology offers exceptional efficiency in waste management. RETARCH demonstrates a maximum anaerobic digestion rate of 95%—more than double that of other biodegradable materials—and decomposes ten times faster. The company has secured global credibility with certifications such as USDA Biobased and BPI, ensuring its products meet international standards for sustainability. From resin grades to finished products like films and bags, DAY1LAB provides a complete value chain for a zero-waste future.

Upcoming Events

Education Korea 2026

21-23 Jan | Seoul, Korea | EduTech

A premier trade show showcasing the latest in future education technology and innovative learning solutions to drive the digital transformation of global education.AI SEOUL 2026

30 Jan | Seoul, Korea | AI

A high-level global summit where AI industry leaders and experts gather to discuss the latest trends, ethics, and industrial applications of artificial intelligence.ELECS 2026

4-6 Feb | Seoul, Korea | Energy

A specialized exhibition focusing on electric power equipment and smart energy solutions, highlighting the future of sustainable energy infrastructure.Korea Build Week

4-7 Feb | Ilsan, Korea | Construction/Architecture

The largest comprehensive construction and architectural exhibition in Korea, covering everything from eco-friendly building materials to smart home and interior design.Semicon Korea

11-13 Feb | Seoul, Korea | Semiconductor

An essential industry event that connects global semiconductor equipment and materials companies to showcase the latest microelectronics manufacturing technologies.InterBattery 2026

11-13 Mar | Seoul, Korea | Battery

The world’s leading battery exhibition representing the entire industry chain, from materials and components to advanced cell manufacturing and EV battery technology.

Thank you for reading Factory’s Post!

We’re always open to exciting news, promotions, and proposals to share with the 123 community. Feel free to contact [email protected], we’d love to hear from you! 😀